What is Call Center Compliance? Why It Matters in 2024

Ensure your call center operations meet stringent laws and standards with our expert insights on call center compliance. Stay compliant and avoid costly penalties.

Phone Service USA - Small Business - What is Call Center Compliance? Why It Matters in 2024

Call centers are the frontline of customer interaction for businesses. Compliance is essential for protecting consumer rights, data security, and ethical business practices. With advancing technology and stricter regulations, a strong compliance program is crucial for thriving in the modern business environment. Violations can result in costly fines and damage to your brand, while a robust compliance program can set you apart from competitors and build trust with your customers.

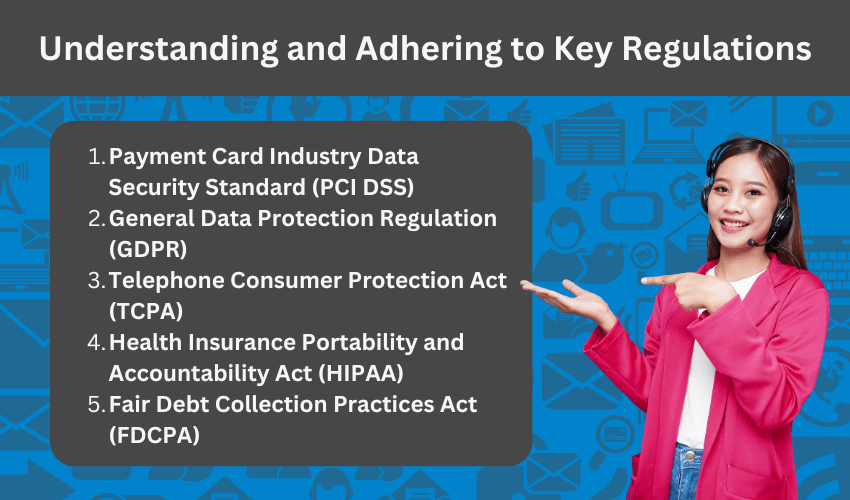

Understanding and adhering to key regulations is crucial for navigating the complex world of call center compliance. Let’s explore some of the most important standards that every compliance call center must follow.

PCI DSS is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. For call centers, this means implementing strict protocols for handling payment information, including:

Compliance with PCI DSS is not just about avoiding fines; it’s about protecting your customers’ financial information and maintaining their trust.

GDPR has revolutionized data protection and privacy in the European Union and beyond. Call centers must comply with GDPR regulations, particularly in handling and storing customer data. This includes:

Even if your call center is not based in the EU, if you handle data of EU citizens, GDPR compliance is mandatory.

The TCPA sets the ground rules for telemarketing practices, protecting consumers from unwanted calls and messages. Key TCPA requirements include:

Telemarketers cannot use automatic dialers to contact wireless phones, and customers can withdraw their consent in any reasonable way at any time. Violating these rules can result in hefty fines and legal action.

For call centers in the healthcare industry, HIPAA compliance is non-negotiable. HIPAA compliance call center practices include:

Call center HIPAA compliance ensures that sensitive medical information remains confidential and secure.

The FDCPA regulates the behavior of debt collectors, including call centers engaged in debt collection activities. Compliance involves:

Adhering to FDCPA guidelines is crucial for maintaining ethical practices and avoiding legal issues in debt collection operations.

The Federal Communications Commission (FCC) continues to evolve its rules to protect consumers, particularly in the area of lead generation. These emerging regulations focus on:

As a compliance call center, it’s crucial to stay informed about these emerging rules and adapt your practices accordingly. This proactive approach not only ensures legal compliance but also builds trust with potential customers.

Ignoring customer requests to opt-out is a breach of trust and a direct violation of regulations like the TCPA. To maintain DNC compliance and respect consumer rights, call centers must:

By tackling these core aspects of call center compliance, businesses can build trust, protect customer data, and confidently navigate the complex regulatory landscape.

Non-compliance in call centers can have far-reaching consequences that extend beyond mere regulatory violations. Let’s delve into the significant impacts that can arise from failing to adhere to compliance standards.

The financial toll of non-compliance can be staggering, often catching businesses off guard with its severity. Here’s what’s at stake:

Text messages and other communication channels must be carefully monitored and managed to avoid non-compliance and escalation. Ineffective compliance management systems can result in systemic failures, amplifying the risk of financial penalties.

While financial repercussions are quantifiable, the damage to brand reputation and customer trust can be even more devastating and long-lasting:

Contact center security is not just about protecting data; it’s about safeguarding your entire business ecosystem. Neglecting regular compliance audits can allow non-compliant practices to persist unchecked, amplifying the risk to your brand’s reputation over time.

Implementing a robust DNC solution is crucial to mitigating these risks. This not only ensures compliance with do-not-call regulations but also demonstrates respect for customer preferences, enhancing the overall customer experience.

Inadequate training of call center agents on compliance issues can lead to mistakes in handling customer data and not following proper protocols. This underscores the importance of ongoing education and training programs to maintain a culture of compliance within the organization.

In conclusion, the impact of non-compliance extends far beyond immediate financial penalties. It can erode the very foundation of trust and credibility that businesses rely on for long-term success. By prioritizing compliance, call centers not only avoid these pitfalls but also position themselves as trustworthy partners in an increasingly privacy-conscious world.

Throughout this article, we’ve seen that call center compliance is crucial for ethical and successful business operations. Compliance includes adhering to regulations, protecting customer data, and maintaining ethical communication standards. Neglecting compliance can lead to legal issues, financial risks, and damage to brand reputation. However, viewing compliance as an opportunity for growth and differentiation can enhance customer trust, improve operational efficiency, and provide a competitive edge. Technology, such as automated monitoring systems and AI-powered analytics, will play an increasingly important role in ensuring compliance. Ultimately, call center compliance is about respecting customers, protecting their interests, and demonstrating a commitment to ethical business practices. Thriving call centers in 2024 and beyond will embrace compliance as an opportunity to excel and set new standards for excellence in customer service and business integrity.

Enhance your call center’s compliance with VoIP technology! Contact Phone Service USA today to discover how our advanced VoIP solutions can help you streamline communication, protect customer data, and stay ahead of compliance regulations. Empower your business to maintain ethical standards and gain a competitive edge!

Ensure your call center operations meet stringent laws and standards with our expert insights on call center compliance. Stay compliant and avoid costly penalties.

Improve customer retention by showing appreciation. Reward loyalty and keep customers coming back with proven strategies that strengthen relationships.

VoIP technology is revolutionizing the telecom industry. Learn about its transformative journey and how it benefits your communication needs!